Description

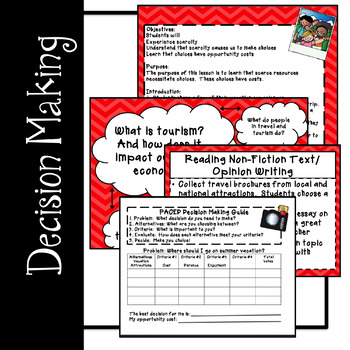

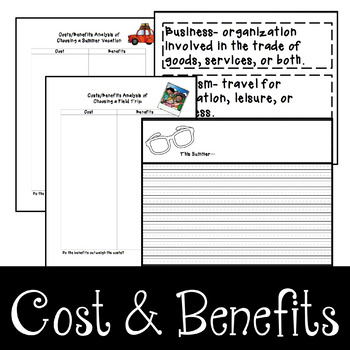

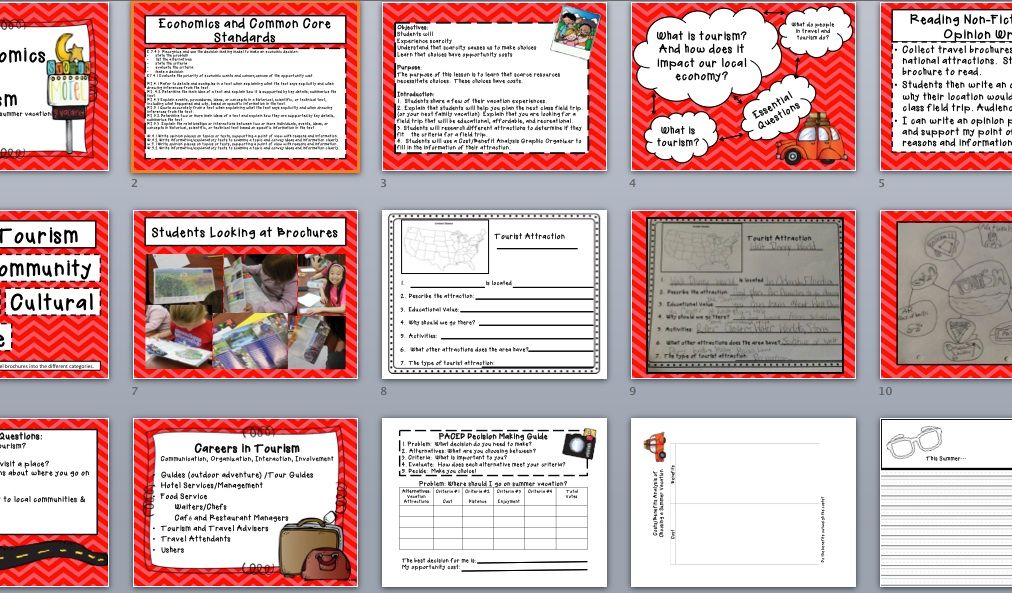

Economics and Tourism is an economic unit where students experience the scarcity of resources in choosing a vacation. Students will learn how to make informed decisions and are introduced to the PACED Decision Making Guide to choose their summer vacations. Students will learn that choices have opportunity costs. Students will also write informational opinion text to promote a vacation attraction. Students will use graphic organizers to see the costs and benefits of each of their choices.

Other products you may like:

Reviews

There are no reviews yet.